The House Just Passed it’s Big Tax Reform Bill -Here is What’s In It

An Attempt to Overhaul the Existing American Health Care System with a Sweeping Tax Reform Proposal

![]() On Thursday, November 16, 2017, the GOP, President Trump and GOP House Speaker Paul D. Ryan (R-Wisc) won a major victory as the House passed its tax reform bill, the “Tax Cuts and Jobs Act.” Designed as an effort to boost the American economy, the bill is the central piece of the Republican plan to do so. Ryan stood to lose 22 GOP votes but, in the end, only lost 13. No Democrats voted for the bill and the final tally revealed 227 votes in favor and 205 votes no in favor of the GOP’s Tax Cuts and Job Act.

On Thursday, November 16, 2017, the GOP, President Trump and GOP House Speaker Paul D. Ryan (R-Wisc) won a major victory as the House passed its tax reform bill, the “Tax Cuts and Jobs Act.” Designed as an effort to boost the American economy, the bill is the central piece of the Republican plan to do so. Ryan stood to lose 22 GOP votes but, in the end, only lost 13. No Democrats voted for the bill and the final tally revealed 227 votes in favor and 205 votes no in favor of the GOP’s Tax Cuts and Job Act.

On November 2, 2017, GOP Leaders in the House of Representatives made their biggest move yet by unveiling the details and legislation for their tax reform proposal. Coming in at 429 pages, and now being referred to as the “Tax Cuts and Jobs Act”, the proposal was publicly announced by House Ways and Means Committee’s Chairman, Kevin Brady. (R-TX), and is the only and boldest tax code reform legislation introduced in 31 years.

With a cost estimated to be $1.51 trillion in the next decade, which effectively means a raise in the federal deficit over the next 10 years of $1.51 billion, the Tax Cuts and Jobs Act expands upon areas that were mentioned in a nine-page high-level document released in September 2017 by congressional Republicans and the Trump Administration.

The Tax Cut and Job Act’s framework comes as a disappointment for middle-class people in the United States as a family of four, with the  median household income $59,000, is estimated to only receive a tax cut of $1,182 annually. The bill consists of a vast collection of proposed changes that will affect the taxing of individuals and the taxing of businesses. As it stands right now, the bill appears to heavily favor corporations, who will be delivered a significant tax cut if the proposal is not amended and changed before it is signed into law; far more modest savings will barely even be noticeable to average middle-class families. Resembling more of a tax plan long advocated by businesses, House Speaker Paul D. Ryan (R-Wisc) explained: “With this plan, we are making pro-growth reforms, so that yes, America can compete with the rest of the world.”

median household income $59,000, is estimated to only receive a tax cut of $1,182 annually. The bill consists of a vast collection of proposed changes that will affect the taxing of individuals and the taxing of businesses. As it stands right now, the bill appears to heavily favor corporations, who will be delivered a significant tax cut if the proposal is not amended and changed before it is signed into law; far more modest savings will barely even be noticeable to average middle-class families. Resembling more of a tax plan long advocated by businesses, House Speaker Paul D. Ryan (R-Wisc) explained: “With this plan, we are making pro-growth reforms, so that yes, America can compete with the rest of the world.”

Republican legislators were dealing with an absolute: the need to maintain the cost of the Tax Cuts and Jobs Act at $1.5 trillion in order to avoid a Democratic party filibuster and pass the bill along party lines. This is why Republican lawmakers scrambled for weeks to compensate for the bill’s costs by suggesting the repeal of very longstanding tax breaks- medical expense tax breaks being a prominent example.

As could only be expected, practically instantaneously, a metaphorical fire was ignited and floodgates opened, primarily by dissenters of the Tax Cut and Job Act. Democrats, special interest groups, lobbyists and business groups all began the inevitable process of tearing the bill apart, in an effort to make sure it was not going to be on President Trump’s desk for ratification by Christmas 2017.

Seemingly unfazed by a disheartening reaction and having expected such negative feedback and onslaught, Republican lawmakers remained determined to assemble for their first official “markup” of the Tax Cut and Job Act two business days later on November 6, 2017. Brady continued to insist that the House of Representatives should pass the proposal before Thanksgiving. Adding that the Tax Cut and Job Act has the “full support” of President Trump’s administration, Brady noted that: “We’re going to prove them wrong once and for all.” After reiterating his desire for a “ready-to-go” bill by Christmas, a statement of support from President Trump said the following: “My administration will work tirelessly to make good on our promise to the working people who built our nation and deliver historic tax cuts and reforms — the rocket fuel our economy needs to soar higher than ever before.”

Republican members of Congress, especially those serving on the Ways and Means Committee, refused to be deterred by negative commentary. The top Republican tax author, Representative Peter Roskam (R-Illinois), said he was braced for such onslaught. Brady added that: “We’ve just finished the opening ceremonies of the lobbyist Olympics. My phone has all kinds messages and there are all kinds of criticisms…the notion of just defending the status quo is insufferable and we’re not going to do it.”

As a matter of fact, Republicans were almost the first people to acknowledge that the Tax Cut and Job Act needs to be reviewed with a fine-toothed comb if current advocates want a tax reform bill with bipartisan support This is why Republicans prepared for negotiations that will require concessions on the part of both political parties. A good example of a concession that Republicans have already made is allowing the 39.6% tax bracket to remain in existence, albeit with some changes, in an effort of to gain support from moderates and dismiss accusations of the Tax Cut and Job Act being just another bill created to benefit high net-worth individuals and big business. Afterall, that nine page framework released in September 2017 reads that: “Too many in our country are shut out of the dynamism of the US economy, which has led to the justifiable feeling that the system is rigged against hardworking Americans…with significant and meaningful tax reform and relief, we will create a fairer system that levels the playing field and extends economic opportunities to American workers, small businesses, and middle-income families..”

“This isn’t the last product,” noted Carlos Curbelo (R-Florida) of the Ways and Means Committee. “This is just the kickoff to this tax reform exercise.” Furthering this point, Brady admits that he even made technical alterations to the proposed legislation on November 1, 2017, one day before the proposal was unveiled to the public.

Brady continued by emphasizing that the real nitty-gritty work will start right away as the House panel tackles the task of “making more substantive improvements to the bill” when it gathers. Promising completed work by November 9, 2017, Brady is ready to embark on “four days of open, full-throated debate.” Brady kept this promise.

Notable & Key Details of the Tax Cut and Job Act

Depending on many factors, different groups and different individuals stand to benefit, or stand to lose, in different ways from tax reform. The demographic characteristics of the population that gains or losses cannot really be accurately identified, at this point in time. Success of the Tax Cuts and Jobs Act almost entirely hinges on economic theories of a controversial nature, which assume tax cuts for businesses and the wealthy mean economic growth and wage gains for everyone else- a conclusion that legislators and economists have debated and questioned for decades. What is clear is that the effects of the Tax Cuts and Jobs Act will be distributed among different income groups, localities, professions and other factors. A high-level summary identifying key points of the bill had been provided by the House Ways and Means Committee initially and now an updated high-level summary has since been provided to reflect changes made. We would like to elaborate on these notable points with our own summary; take a look to learn more about the Tax Cut and Job Act:

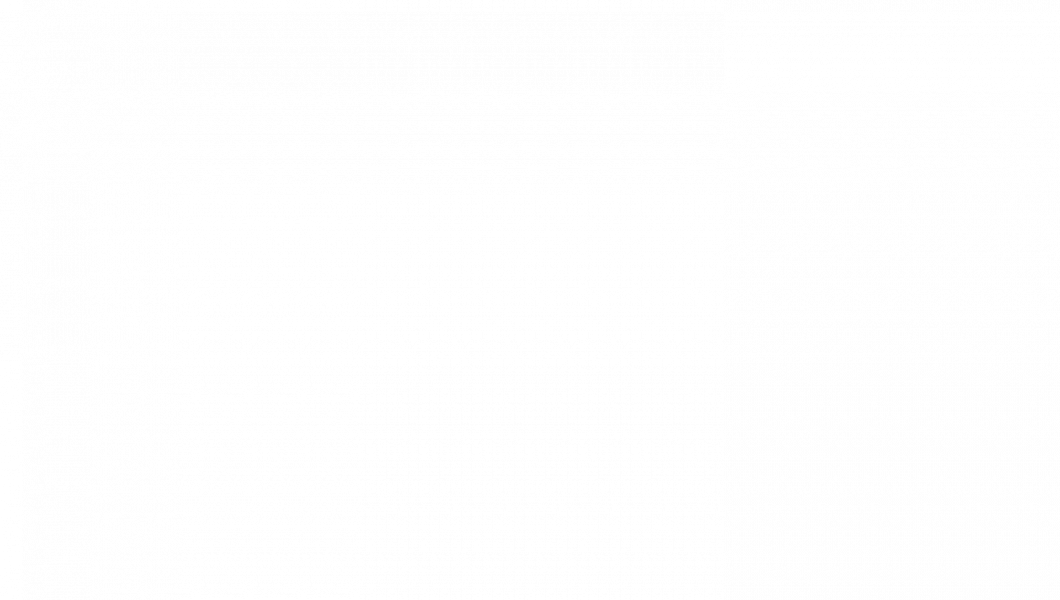

Individual Tax Rate Simplification

Republican legislators had originally planned to simplify the current individual tax plan’s seven existing income tax brackets into three brand new brackets, one of which would be a reduced top bracket rate from 39.6 percent to 35 percent. In light of reactions to this idea, and President Trump’s commitment to not shifting any financial burden on lower- and middle-class earners, the preliminary Tax Cuts and Jobs Act proposal was adjusted to keep the existing top bracket.

Republican legislators had originally planned to simplify the current individual tax plan’s seven existing income tax brackets into three brand new brackets, one of which would be a reduced top bracket rate from 39.6 percent to 35 percent. In light of reactions to this idea, and President Trump’s commitment to not shifting any financial burden on lower- and middle-class earners, the preliminary Tax Cuts and Jobs Act proposal was adjusted to keep the existing top bracket.

When one takes the zero percent tax bracket and the retention of the 39.6 percent bracket into account, five individual brackets are now proposed by the Republican leaders. We are first going to define the three more straightforward brackets, then discuss the zero and 39.6 tax brackets:

-

- 12%: Includes incomes up to $45,000 per individual and $90,000 for a joint filing couples.

- 25%: Includes incomes up to $200,000 per individual and $260,000 for a joint filing couples.

- 35%: Includes incomes up to $500,000 per individual and $1 million for a joint filing couples.

“Zero Tax Bracket” Expansion

The framework of the Tax Cuts and Jobs Act’s proposal is attempting to make less income of a typical middle-class family subject to federal income tax. The idea here is that tax relief and tax code provisions in the proposal will garner tax savings for the middle-class. Such savings would come from the also proposed increase in the standard deduction, which would double in size according to the proposal. As an example, the new standard deduction would be $12,000 for single filers (currently, it is $6,350) and $24,000 (currently, it is $12,700) for those who file jointly.

A simplification of the current tax code is achieved by a higher standard deduction because, in turn, this would eliminate cumbersome personal exemptions as they would be consolidated into the higher standard deduction. The GOP contends that this arrangement is more fair and far more easy than the current tax code. The term “zero percent tax bracket” is slightly misleading because it does not mean that all income will not be taxed. Rather, it will make $12,000 of income for individual filers and $24,000 of joint filer income not taxed.

Retention of the 39.6% Individual Tax Rate

Republicans were prepared for negotiations regarding the nation’s highest individual tax bracket of 39.6 percent. Original framework specifically mentions that a top individual tax rate of 35 percent may need to be made. In September 2017, preliminary framework reads: “An additional top rate may apply to the highest-income taxpayers to ensure that the reformed tax code is at least as progressive as the existing tax code and does not shift the tax burden from high-income to lower- and middle-income taxpayers.”

A last-minute change, concerning the retention of the 39.6% tax rate, was included in the GOP’s proposal in order to assuage a barrage of negative and worried feedback that eliminating the country’s highest tax bracket would only benefit the wealthy. The 39.6 percent tax bracket would still be used for the taxation of high-income people earning more than $1 million annually. From a deficit standpoint, retaining the 39.6% tax bracket would lower the national deficit by around $200 billion during the next decade, according to the Committee for a Responsible Federal Budget. However, in the existing code, filers are in the 39.6 percent tax bracket if they earn more that $470,700, meaning that taxes will still be reduced for earners making under $1 million annually.

Raising of the Standard Deduction

To avoid higher taxes on earners presently in the 10% tax bracket, the standard deduction for all taxes would be changed to $12,000 for individuals. As mentioned, this amounts to a new standard deduction just a tiny bit less than as if the deduction was doubled. Josh Barro of Business Insider has been vocal about this stipulation, as he criticizes it as being misleading because it eliminates many personal deductions. The proposal expands the standard deduction to $24,000 for married couples, from $12,700, and $12,000 for individuals, from the current $6,530.

Elimination of Most of Personal Credits and Itemized Deductions

Simplification of the current tax code, according to the Tax Cuts and Jobs Act, means eliminating most itemized deductions. Tax incentives for charitable giving and home mortgage interest will remain, with the mortgage interest deduction capped at $500,000, down from its current $1 million cap. The following itemized deductions and tax credits are on the Tax Cuts and Jobs Act’s chopping block:

-

- Tax preparation/tax preparer deductions

- Plug-in motor vehicles tax credits

- Moving deduction expenses

-

- Exemptions will be allowed for members of the American military

-

- Deduction for loss of valuables or theft deductions

-

- Exemptions will be allowed for losses sustained due to a natural disaster, such as Hurricane Harvey

-

- Tax benefits for higher education/college

-

- Currently, middle and low income taxpayers can deduct up to $2,500 in student loan interest expenses annually- this benefit will no longer be available as of 2018. If a student is still enrolled in school, the current American Opportunity Tax Credit, which allows for a credit of $2,000 for higher education costs, will still be available

- Graduate students who teach or do research, and currently get tuition waivers, will now be subject to an income tax on those waivers.

-

- Medical expense deductions

-

- For individuals who spend over 10% of their income on medical costs, current law allows these people to deduct a portion of those costs from their taxes. The Tax Cuts and Jobs Act removes this deduction.

- The GOP contends that, although the deduction will disappear, families will barely notice any change, because of a higher overall tax reduction because of the standard deduction, will compensate those families.

-

Partial Elimination of State and Local Tax (SALT) Deductions

Current tax code allows for the deduction of state and local taxes from taxable federal income. As probably the toughest sell in the Tax Cuts and Jobs Act proposal and a possible dealbreaker, the GOP proposal, for the very first time, is trying to eliminate the option to deduct SALT from federal taxes. Although the proposal will still allow taxpayers to deduct state and local property taxes on their federal tax returns, even that will have a cap of $10,000 allowed for deduction purposes.

Current tax code allows for the deduction of state and local taxes from taxable federal income. As probably the toughest sell in the Tax Cuts and Jobs Act proposal and a possible dealbreaker, the GOP proposal, for the very first time, is trying to eliminate the option to deduct SALT from federal taxes. Although the proposal will still allow taxpayers to deduct state and local property taxes on their federal tax returns, even that will have a cap of $10,000 allowed for deduction purposes.

One of the biggest hangups for Republicans in states like New York, New Jersey, and California has been the proposed modifications to SALT deductions. In fact, the Committee for Responsible Federal Budget studies have revealed that California and New York alone receive just over 30.5% of the aggregate SALT deductions claimed. Democrats and some Republicans are very concerned about the livelihood of their respective districts. Dan Donovan (R-NY) has noted his concern about the impact of the SALT deduction as he left a briefing on the bill but claims he would address the proposed SALT legislation in its entirety. “I’m looking for a benefit for the people I represent,” he said. “The people of New York City deserve a tax break.” Tom MacArthur (R-NJ) partially accepts the concept of keeping the deduction for property taxes as a middle-ground but feel that the $10,000 cap “needs to come up a little bit.”

Home Mortgage Interest Deduction Limitations

The current deductible limit for new home purchases is $1 million. The Tax Cuts and Jobs Act proposal allows for a deduction, but only for interest on loans up to $500,000. According to the Tax Foundation, the mortgage interest cap would hurt high-income taxpayers more than those in the middle- and lower-income brackets, because they likely own larger homes and have higher mortgage debt.

Child Tax Credit Increase & Preservation of Child and Dependent Care Tax Credits

- Creation and implementation of a new “Family Credit”. Such a credit will include the expansion of the Child Tax Credit to $1,600 from $1,000 and is designed to help parents with children raising costs. Also provided is a credit of $300 for each parent and non-child dependent to assist families with their normal everyday expenses.

- Preservation of the Child and Dependent Care Tax Credit to assist families care for their respective children, including older dependents- such as a disabled grandparent who requires additional support.

- Preservation of the Adoption Tax Credit so to provide tax relief to those who open their home to an adopted child.

Corporate Tax Reductions

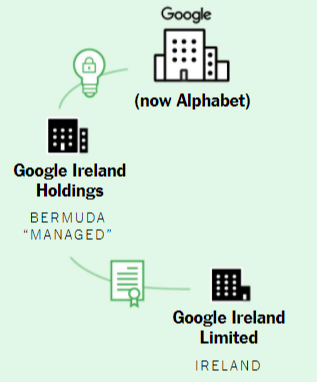

Effective immediately, the corporate tax rate will permanently drop to 20 percent from its current 35 percent rate- corporate taxes will plummet as a result. According to the tax reform proposal, this rate change will be permanent; however, concern surrounds whether or not a permanent reduction would be sustainable from a budget standpoint. On top of that, companies would get some new tax breaks to help lower their bills, such as the ability to deduct all the costs of purchasing new equipment for five years, as well as a special low rate on any money they bring back to the United States from low-tax countries such as Ireland like companies such as Google. The Tax Cuts and Job Act is in accordance with President Trump’s 20 percent corporate tax rate goal and represents a decrease from the current maximum of 35 percent. House Majority Leader Kevin McCarthy (R-California) has stated that the proposal would decrease the corporate tax rate, as demanded by Trump. Also, the proposal eliminates the corporate alternative minimum tax.

AMT Tax Repeal

The individual alternative minimum tax (AMT) integrated into the nation’s tax code as a way to force qualifying taxpayers with excessive amounts of deductions is set to be repealed, according to the proposal. Expected to affect more than 4.5 million families in 2017, including President Trump’s enterprise which has been shown to be millions of dollars more because of the tax. Both the Internal Revenue Service (IRS) Taxpayer Advocate and the nonpartisan Joint Committee on Taxation (JCT) have recommended the repeal of the AMT citing that it has ceased to serve its original and intended purpose; it also adds a very high level of unnecessary complexity. Simplification of the tax code can be achieved by eliminating the existing individual AMT, which requires taxpayers to complete their respective taxes twice.

The individual alternative minimum tax (AMT) integrated into the nation’s tax code as a way to force qualifying taxpayers with excessive amounts of deductions is set to be repealed, according to the proposal. Expected to affect more than 4.5 million families in 2017, including President Trump’s enterprise which has been shown to be millions of dollars more because of the tax. Both the Internal Revenue Service (IRS) Taxpayer Advocate and the nonpartisan Joint Committee on Taxation (JCT) have recommended the repeal of the AMT citing that it has ceased to serve its original and intended purpose; it also adds a very high level of unnecessary complexity. Simplification of the tax code can be achieved by eliminating the existing individual AMT, which requires taxpayers to complete their respective taxes twice.

Small Business Tax & Taxation on Pass-Through Income Precautions

95 percent of American businesses are organized as pass-through companies (LLCs, S-Corps, partnerships), and they “pass through” the business income to the owner’s individual tax rate. Rather than having taxpayers taxed at an individual rate, owners of pass-through businesses would no longer be subject to this taxation method. Under the proposal, pass-through business income would lower the top rate from 39.6 percent to taxed at 25%- just as Republicans have been promising. This would be the lowest tax rate that Main Street job creators have seen since World War II. The National Federation of Independent Businesses, the largest small business lobby group just gave their blessing.

Legislators recognize that there need to be stringent guardrails as to what types of small businesses can claim the 25% tax rate (excluding “service companies” like consultants and lawyers) so certain businesses do not abuse the existence of the lower tax rate and consider it a loophole. As a result of this, tax-writers have developed a formula that they insist will ensure that business owners remain subject to their individual tax rate on the wages portion of their income. Circumstances of the business would be considered to make sure taxation is fair.

Hundreds of thousands of businesses, which currently, remit their taxes via the individual income tax code would experience a massive tax rate reductions as a lower rate of 25 percent replaces the nation’s current highest tax bracket of 39.6 percent. It remains to be seen exactly what new provisions will be put in place to prevent the wealthier from creating companies so respective income would be taxed at the lower 25 percent rate.

Lower Tax Rate of 9% for Businesses Earning Less than $75,000

The Tax Cuts and Jobs Act offers a 9 percent tax rate, To help out the small “mom and pops,” in lieu of the ordinary 12 percent, for the first initial $75,000 in net business taxable income for an active owner or shareholder earning under $150,000 in taxable income from a pass-through business. As taxable income increases and exceeds $150,000, the benefit of the 9 percent relative to the 12 percent rate is lowered up to $225,000. All types of businesses are eligible for the 9 percent and apply to any and business income up to $75,000. Subsequently, the 9 percent is phased in over a period of five taxable years. The rate for 2018 and 2019 will be 11 percent, the rate for 2020 and 2021 will be 10 percent and the rate for 2022 and after is 9 percent.

Capital Investment Expensing

The House GOP Tax Cuts and Jobs Act allows businesses to instantaneously expense (or write-off) capital investments, as an example: new equipment, for five years. After that five year period, however, the ability to deduct interest payments is cut back. This provision has significance and represents an unprecedented level of expense, as far as duration and scope of eligible assets.

Preservation the Earned Income Tax Credit

In order for lower-income Americans to continue to build better lives for themselves, tax relief in the form of the Earned Income Tax Credit is maintained. The program will be held to strict integrity, as three new provisions have been added to the programs. The first stipulation will require credit claims to properly reflect self-employment net earnings. The second stipulation will require employers to have to be able to provide additional payroll information. The third stipulation is that an Earned Income Tax Credit claim be subject to certain authoritative actions of the IRS.

Eventual Elimination of the Estate/Death Tax

The estate/so-called “death tax threshold currently only applies to estates worth more than $5.49 million in 2017, will be nearly doubled to those estates worth more than $10 million. The entire tax would be phased out over a six-year period until 2024 when it will be eliminated.

Retention of Retirement Savings Options, Including 401(k)s

In an effort to help Americans continue to save for their futures, the House tax reform bill will not change the pretax treatment of 401(k) plans. Talking points in the bill note that “Americans will be able to continue making both traditional, pretax contributions and ‘Roth’ contributions in the way that works best for them.”

Preservation of Obamacare’s (Affordable Care Act) Individual Mandate

Trump’s last-moment advocacy for the elimination of Obamacare’s current penalty for not having insurance will remain.

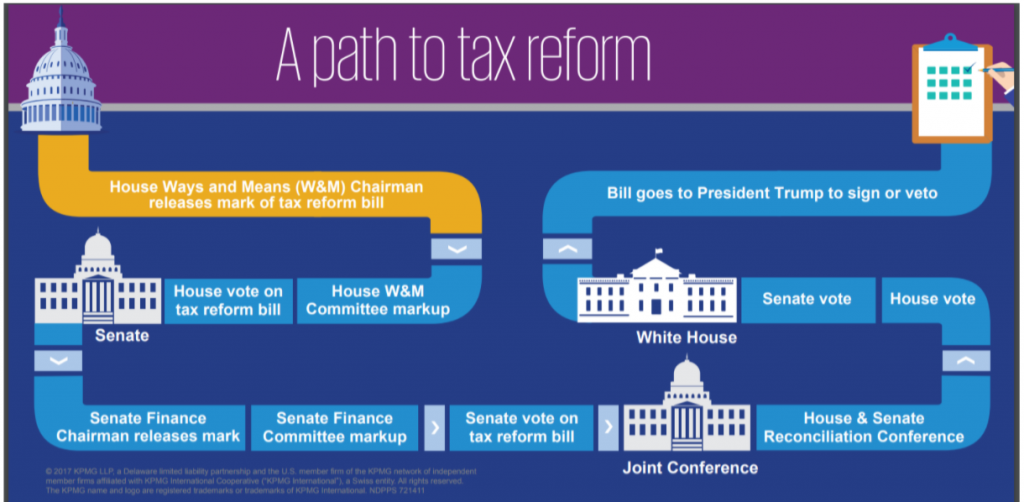

Next Steps: What Will Happen in the Senate?

Simply put, the House Tax Cuts and Jobs Act will not, in its current form, be going anywhere in the Senate. “This bill would not become law as is,” Policy Director at the Committee for a Responsible Federal Budget, Marc Goldwein, said The Senate and House are working on two separate tracks to pass legislation and subsequently have an agreeable bill on President Trump’s desk; broad opinion has the odds of such a quick process and turnaround fairly low. The difference between the Senate bill and House bill is duly noted.

Conclusion

Conclusion

Republicans in both the House of Representatives and the Senate have proposals, and the Senate may vote on its version this week. It’s virtually impossible to fully understand, let alone keep up with, the flood of proposals, procedural developments, amendments and analyses that continue to pour out.

President Trump has relentlessly promised that GOP tax reform “will be the biggest tax event in the history of our country.” Similar to a very complex jigsaw puzzle or maze, innumerable competing interests are just waiting to have their voice be heard on Capitol Hill. Thus far, these voices seem to be foreshadowing the doom of the Tax Cuts and Jobs Act.

President Trump has identified four distinct principles for tax reform:

- Provide a more simple tax code that is more fair, simple and easy to understand.

- Provide a pay raise for hard-working Americans workers by allowing them to keep a larger portion of their income.

- Level the playing ground for workers and businesses in the United States, making the country a “job magnet” of the world.

- Bring trillions of currently offshore dollars into the American economy.

We shall see, the general idea of tax cuts has always been popular, but if the system doesn’t bring in enough revenue to pay for necessities — soldiers’ salaries, highway construction and disaster relief, among others — then the changes could undercut economic growth and the standard of living.

Thomas Huckabee, CPA is a full-service accounting firm in the San Diego, California area. Our accountants and CPAs offer professional help that can help you navigate the current tax code and any alterations to that tax code which may be made into law. Contact us to learn more about the accurate, appropriate and efficient services we can offer our clients.