How the Trump Administration Could Impact Small Business Taxes

In less than five weeks, the 45th president, Donald Trump, will be sworn into office. While talk of actual policy changes has been certainly not always the emphasis on campaigning during a gruelling and unprecedented election, we are now starting to get a clearer picture of some of Mr. Trump’s policy plans. It appears that our next president would like to implement a traditional Reaganomics conservative policy- the proposal of tax cuts across the board to stimulate economic growth. His corporate tax policies—which are vital to his platform of domestic growth and repatriation of U.S. income and jobs—will require significant changes to the Internal Revenue Code. Please note that this post may be speculative since we do not have a crystal ball to predict which tax policy changes will survive and receive Congressional approval. CEOs and business owners should familiarize themselves with these proposed changes well before Trump’s inauguration in order to fully explore the opportunities and risks associated with each corporate tax policy.

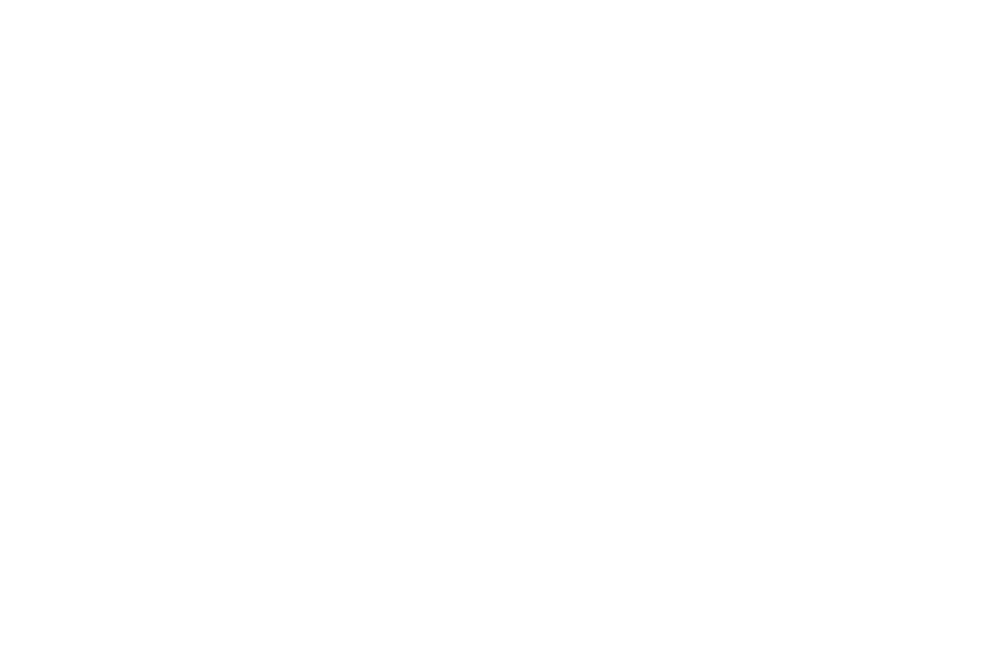

A basic rule of taxation is that a low tax rate on a broad base of income is less distorting—i.e., more efficient—than a high tax rate on a small base. The United States shatters this rule. We have one of the world’s highest corporate income tax rates, 35%; but, at the same time, we also raise far less money from this rate as a share of gross domestic product (GDP).

A basic rule of taxation is that a low tax rate on a broad base of income is less distorting—i.e., more efficient—than a high tax rate on a small base. The United States shatters this rule. We have one of the world’s highest corporate income tax rates, 35%; but, at the same time, we also raise far less money from this rate as a share of gross domestic product (GDP).

This is when we compare the United States to the average of the 35 mostly rich countries in the Organization for Economic Cooperation and Development. U.S. Businesses have found ways to avoid taxes by shifting operations or headquarters abroad or by organizing into entities that aren’t subject to the corporate levy.

Many people feel that the current U.S. business tax system, is so broken that even partial reform would be very beneficial. But, even the smallest of reforms won’t come easy. As with most government changes, modifications to the tax code involve trade-offs.

Despite a Republican majority in both the House and Senate, there is still no guarantee that the Democrats cannot block some of the tax reform bill proposals. As of now, there are a few changes that we can expect to see which include limits on corporate tax expenditures, increase in standard deductions and more simplified tax rates.

The Ways and Means Republican’s tax reform blueprint video explains the party’s pro-growth tax code reform ideas.

Many of these suggested tax changes, if made into law, will have sweeping effects on the economy, which definitely includes startups and small business owners. Below, we have identified some of the most important changes that a 2017 Trump presidency could bring to a small business’s tax protocol.

1. Lowering the Corporate Tax Rate to 15%

After a small business takes care of its expenses, such as paying its employees, rent, insurance, payroll… etc, any remaining profits are currently taxed up to a rate of 35%. This is assuming that the aforementioned businesses are legally registered as corporations. Trump would like to cut this 35% rate down to 15%. For any company that is already profitable, a 20% cut will make a significant difference. But many new entrepreneurs who launched new startups are pre-revenue stage, and therefore won’t be able to capitalize on this change immediately.

“Goldman Sachs economists predicted in a Dec. 3 research note that the corporate tax rate will fall to 25 percent, rather than the House’s 20 percent or Trump’s 15 percent” – Peter Coy, Businessweek Economics Editor at Bloomberg News.

2. Taxing “Pass-Through” Income at a 15% Rate

Many startups are registered as C-corps, while the remainder of many other small to medium size businesses are structured as partnerships, S-corps, and LLCs. Most small businesses are deterred from C corporation status because it imposes two levels of taxation on the same income – —once at the entity level when the income is earned and again at the individual level when the corporation distributes the income to its shareholders in the form of a dividend.

According to the Tax Foundation organization, pass-through entities actually make up close to 95% of all US businesses and produce over 60% of all business income. So, for pass-through business entities, all of the income liability “passes through” the company and then is taxed on the shoulders of the owners. As of now, this company income would be taxed at your personal income-tax rate, which is usually a lot higher than 15% This new proposed change could mean that someone who is taxed at 39.6% on flow-through business income would see his or her pass-through tax rate slashed all the way down to 15%! For very profitable entities, this would be a monumentally huge tax reduction.

According to the Tax Foundation organization, pass-through entities actually make up close to 95% of all US businesses and produce over 60% of all business income. So, for pass-through business entities, all of the income liability “passes through” the company and then is taxed on the shoulders of the owners. As of now, this company income would be taxed at your personal income-tax rate, which is usually a lot higher than 15% This new proposed change could mean that someone who is taxed at 39.6% on flow-through business income would see his or her pass-through tax rate slashed all the way down to 15%! For very profitable entities, this would be a monumentally huge tax reduction.

3. Eliminating the Carried-interest Loophole

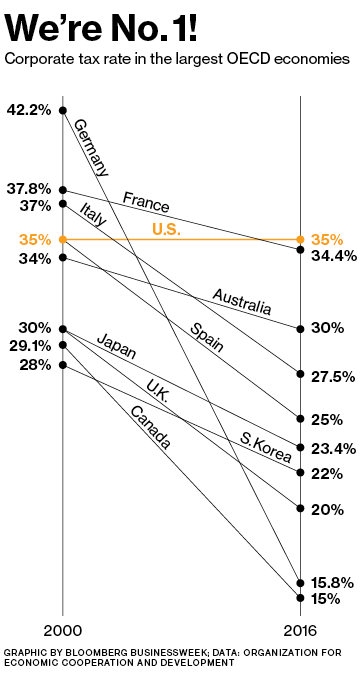

The Carried interest exemption generally benefits partners and workers at investment firms, including those in private equity, real estate, and venture capital.

A private-equity fund buys up all or some of a company, makes some changes, and then hopes to sell that investment in a few years at a profit. The profits, if any, flow through a funnel that ends up in the bank accounts of investment managers and the investors who put up their own capital.

For the fund managers, this share of the profits is usually the bulk of their compensation. Investors often pay 2% of their assets to the operation of the fund, and then 20% on the profits on whatever the fund returns. For the fund managers, that 20% — often many millions of dollars — is taxed as capital gains, not ordinary income, so they find the much of their income taxed at a maximum rate of 20%. The tax code treats that income as a “long-term capital gain,” which is taxed at a lower rate than ordinary income (currently it is a maximum of 20 percent versus 39.6 percent).

For startups and small businesses, the carried-interest loophole does not have a large impact, as most do not carry interest from a private investment fund. Asset and fund managers will feel this though, which could then trickle down to some VC funds in the startup space. But, again the total effects of this is a question mark until the actual provision gets changed. The Congressional Budget Office has estimated that closing this loophole, would generate $20 billion in added revenues from taxing the earnings currently designated as carried interest as ordinary business income over a ten year period.

4. Enacting a “Tax Holiday” to Return Overseas Profits

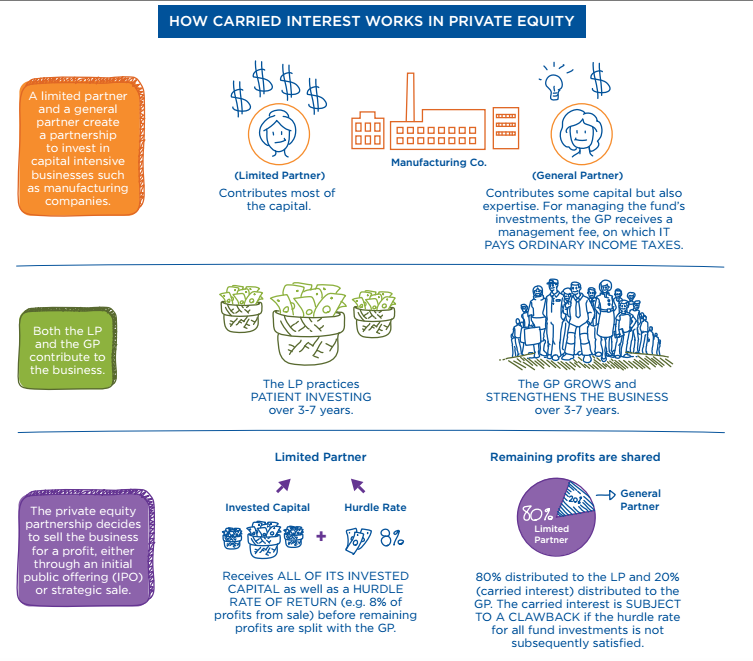

Many companies that have set up foreign corporations to conduct business overseas, such as General Electric, have the ability to bypass the 35% corporate tax rate. Mr. Trump is proposing a way to incentivize companies to bring that $2.6 trillion in untaxed profits back to the United States, and vigorously promote more domestic investment. Learn how US businesses bypass taxes with profit shifting tactics, such as booking income in offshore havens and leaving it there.

Many companies that have set up foreign corporations to conduct business overseas, such as General Electric, have the ability to bypass the 35% corporate tax rate. Mr. Trump is proposing a way to incentivize companies to bring that $2.6 trillion in untaxed profits back to the United States, and vigorously promote more domestic investment. Learn how US businesses bypass taxes with profit shifting tactics, such as booking income in offshore havens and leaving it there.

Trump’s proposed plan would impose up to a 10% deemed “repatriation tax holiday” on the accumulated profits of foreign subsidiaries of U.S. Companies. This 10% toll charge would be payable over 10 years; Trump and his team say this change would trigger a huge inflow of funds back to the U.S. And for the future, Trump’s proposals would tax future profits of foreign subsidiaries of U.S. Corporation’s each year as the profits are earned. With these changes possible, companies will be eagerly waiting for news and possible implementation of this tax change. This 10% tax holiday was last enacted in 2003 by George W. Bush and called the “Homeland Investment Act.”

This could all be good news for the startup community. Theoretically, some of this tax holiday money may be put back into the startup investment ecosystem – think investments into incubators, internal projects, mergers and acquisitions…etc. These tax proceeds have typically been used to pay out dividends or for stock buybacks- all the benefit of shareholders. If this happens, some economists are estimating that $200 billion in additional revenues from a one-time 10% tax on un-taxed foreign profits, instead of the 35% tax could be generated. Nonetheless, only time will tell if this has any real effect on small businesses.

5. Eliminating Corporate Tax Expenditures

Trump is also proposing to remove corporate tax expenditures and loopholes, especially those that benefit special interests. Some of the loopholes” include domestic production activities deduction (section 199) and all business tax credits, except the R & D research tax credits will remain in place. The elimination of deductions will definitely have an effect on small business, although it will not have the same impact on startups that are not profitable yet. Another example, of a business tax credit, that Trump proposes to repeal includes the work opportunity credit under Code section 51(a), which allows employers to claim a credit for a portion of the wages paid to targeted groups such as qualified veterans. Remember that most startup businesses are pre-revenue, meaning that they will not be affected by this change.

6. Instituting Childcare Tax Credit

Another potential win for businesses is the proposal to increase the tax credit for companies with childcare onsite. As of now, this tax credit is set at $150,000; President-elect Trump is proposing to increase this threshold to $500,000. If your business provides this service to your employees, this potential change definitely warrants attention.

Conclusion

Not everyone is thrilled about Trump’s proposals, with much of the his tax plans criticism going to say that the new administration will give the largest breaks to 1% income earner club. It’s important to keep in mind, that Trump’s pre-election positions on tax reform may not necessarily translate into proposed legislation, he may soften or compromise on certain things. So Trump is proposing a 15 percent tax for all businesses. House Republicans want a 20 percent tax for corporations and 25 percent for partnerships and similar entities. What we do know is that change in the tax code and world are constant. Yet by any standards, some of the tax changes likely in 2017 and beyond are going to be huge. Congress may have to enact billions in federal spending cuts over the decade to offset some of the tax cuts and infrastructure spending. Will we have the lofty 4% GDP growth that Trump hopes for? Karen Kerrigan, president and CEO of The Small Business and Entrepreneurship Council (SBE Council), is optimistic and looks forward to working with Trump’s administration, stating that –

“His agenda of lower taxes and simplifying the tax code, relieving small businesses of excessive regulation and red tape, competitive solutions for more affordable health insurance, bringing down barriers to capital access and formation, leveraging our energy resources and America’s energy renaissance more fully, smarter trade agreements, and advancing growth-oriented policies to restore healthy investment won the day.”

Thomas Huckabee CPA Tax specialists will be monitoring tax reform legislation as it moves through the late stages of discussion and will provide you with further updates. At this point, we don’t expect to see a first mark-up from the House Ways and Means Committee until sometime in March.

As with any tax proposal, consult your CPA or tax advisor before changes pass through legislation or executive order and become law. Discover if your business should be making any changes, or restructuring to take advantage of what is to come. You will be in the best position if you monitor what happens for your business and you once these changes take place in 2017.